According to the EIS contribution table 02 will be paid by the employer and 02 will be cut from the employees monthly wages. Berikut table caruman socso untuk gaji di bawah RM2100 sebulan.

Why To Increase Sip Amount In Your Mutual Funds

Share Incentive Plans SIPs If you get shares through a Share Incentive Plan SIP and keep them in the plan for 5 years you will not pay Income Tax.

. Systematic Investment Plan or SIP as it is commonly known is an investment plan methodology offered by Mutual Funds wherein one could invest a fixed amount in a mutual fund Scheme periodically at fixed intervals - say once a month instead of making a lump-sum investment. It is a financial scheme aimed at helping employees who lost their jobs until they find new employment. Total SOCSO Contribution of Flexi is RM8880 however for an employees monthly salary exceed RM3000 is able to choose whether he or she want to contribute to SOCSO or not.

This calculation only applicable to Loss of Employment LOE starting from 1st January 2021 until 30th June 2022For LOE happened before 1st January 2021 click HERE to calculate the benefit. IMPACT OF 2021 CONTRIBUTION RATE ON REGULAR SS PROGRAM AND WISP For SE contributing at the maximum MSC of 25000 the additional amount for the monthly SSS contribution is also 850 or about 29 per day. The EPA is responsible for administering the Environmental Impact Statement according to EIS Table process.

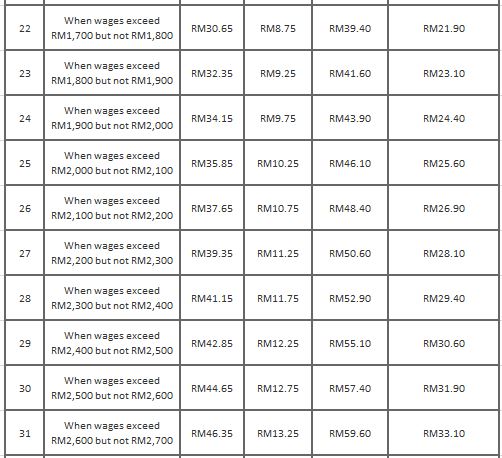

Amfi data released for the month of December said investors invested a net. Stats displayed in columns and rows with title ID notes sources and release date. For monthly salarywages gaji more than RM1000 and up to RM4000 you may refer to this infographic of the EIS Contribution Table Kadar Caruman SIP.

They will be more than happy to help you out and the best part is all advising is free of charge. This calculator helps you calculate the wealth gain and expected returns for your monthly SIP investment. If you find yourself in doubt about anything pertaining to the SOCSO fun do not hesitate to contact one of our friendly customer service agents.

The number of monthly contributions you have paid before. For LOE starting from 1st January 2021 until 30th June 2022 click HERE to calculate your benefit. It also aims to provide extended welfare.

Benefits are calculated based on your previous assumed salary and your Contributions Qualifying Conditions CQC. Heres what is known as tapered SIPP allowance comes into play where the average maximum annual SIPP allowance of 40000 reduces by 1 for every 2 you put into your SIPP. Employment Insurance EIS contributions are set at 04 of an employees estimated monthly wage.

Wages Above RM 2900. The sources of the data published on census. BENEFIT CALCULATOR SIP PRIHATIN Note.

Financial Process Exchange FPX You may refer to the EIS submission User Guide on how to make payment via FPX. Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary. Equity mutual funds saw a total inflow of Rs 4357950 crore and outflow of Rs 1850279 crore.

The Employment Insurance System EIS was first implemented in January 2018 by PERKESO. Wages between RM 2800 and RM 2900. Many tables on censusgov are in downloadable XLS CVS and PDF file formats.

Since the amount is invested on regular intervals usually on monthly basis it also reduces the impact of market volatility. Kadar dan jadual Caruman untuk SIP Socso Oleh Pekerja dan majikan di Malaysia melalui akta keselamatan sosial perkeso tahun 2022 Sebagai pekerja di Malaysia. SELF-EMPLOYED MSC OLD CONTRIBUTION RATE REGULAR PROGRAM 3000 10000 20000 25000 370 1210 2430 2430 1210 400 1310.

If you are using a screen reader and are having problems accessing data please call 301-763-3243 for assistance. Net inflows in equities plummet to 4-year low SIP contribution tanks below Rs 8000 crore Net inflows in equities plunged 94 month-on-month in June according to report released on Tuesday by Motilal Oswal Institutional Equities. According to the SOCSO contribution table 2022.

You get a rough estimate on the maturity amount for any monthly SIP based on a projected annual return rate. AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 001 to 1000 NIL NIL NIL From 1001 to 2000 300 300 600 From 2001 to 4000 600. Electronic Funds Transfer EFT For EFT payment you may need to contact PERKESOs customer service at 1-300-22-8000 or email to perkesoperkesogovmy for more information.

SIPP Income Data Tables. It hits its minimum of 10000 if you make more than 210000. Benefits are calculated based on your previous assumed salary and your Contributions Qualifying Conditions CQC ie.

Contribution By Employer Only. The SIP contribution calculator needs the final target amount step-up if any CAGR return annually time period date of SIP etc as the inputs to calculate the target monthly SIP contribution. EIS contribution table.

The SIP installment amount could be as small as 500 per month. Contribution rates are set out in the Second Schedule and subject to the rules in Section 18 of the Employment Insurance System Act. For RM450001 or above.

The contributions are being collected in a fund in order to provide financial assistance to retrenched employees. Payment Options for EIS. 4 Jadual potongan perkeso untuk gaji di bawah RM4000 setiap bulan.

The systematic investment plan SIP for December 2021 hit its highest ever at Rs 1130534 crore crossing Rs 11000 crore mark for the second consecutive month. EIS Contribution Table Download. 3 Untuk gaji di bawah RM3600 setiap bulan.

When wages exceed RM30 but not RM50. Please refer to the following table for more information. If you make more than 210000 per annum your SIPP contribution limit would be limited to.

02 will be paid by the employer while 02 will be deducted from the employees monthly salary. SIP KSM diminta melihat semula kadar caruman dan kemampanan dana EC ke-4 EC bersetuju SIP dilaksanakan mulai 1 Januari 2018 Simulasi kewangan dipersetujui hybrid Pelaksanaan dikaji supaya tidak membebankan Kerajaan Undang-undang SIP memberi kuasa kepada Menteri untuk meminda caruman dan siling gaji ETLB dikekalkan dan pembaharuan undang-. Wages up to RM30.

Staff Insurance 最新落實2018年員工保險sip Thestepheny 人生的旅客

Why To Increase Sip Amount In Your Mutual Funds

Eis Perkeso Eis Contribution Table Eis Table 2021

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

How To Compute Sss Contribution Pag Ibig Philhealth And Bir Wt 2019

Insert Legislation Tables E Leave Online System Leave Time Claims Management Plus Payroll Outsourcing

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

New Sss Contribution Table 2019 Bigger And Better Benefits

How Epf Employees Provident Fund Interest Is Calculated

New Sss Contribution Table 2019 Bigger And Better Benefits

New Sss Contribution Table 2019 Bigger And Better Benefits

How The U S Sip Really Works The World Federation Of Exchanges

New Sss Contribution Table 2019 Bigger And Better Benefits

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Malaysia S New Insurance System Automatically Asklegal My

Employment Insurance System Neelian Corporation Sdn Bhd Facebook

How To Compute Sss Contribution Pag Ibig Philhealth And Bir Wt 2019

2021 Sss Contribution Table For Employees Self Employed Ofw Voluntary Members Pinoy Money Talk Contribution Employment Agency Sss

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

- larkin residence phase 2

- wiring kereta shah alam

- background biru ukuran gambar passport

- perpaduan kaum di malaysia karangan

- income tax relief 2020 malaysia

- semakan kad diskaun siswa

- smk p bukit kuda

- jumlah penduduk malaysia tahun 2017

- matematik tingkatan 3 kssm

- hotel di padang besar

- english year 1 kssr textbook

- bintik2 merah gatal tapi bukan gigitan nyamuk

- lambang negeri sabah

- how to trade bitcoin in malaysia

- bagus ke polish kereta

- contoh surat pengesahan penjaga tidak bekerja

- brim semakan status permohonan

- taman bunga raya klang

- doa hari kelahiran dalam islam

- taman sri rampai kuala lumpur federal territory of kuala lumpur